About us

Image caption

Image caption

Belters is a Polish company operating in the IT industry. The members and founders have been gaining experience in this industry since 2006. Belters is co-created by highly motivated people with a passion for action who deeply value the idea of freedom in the broadest sense of the word, and who have extensive experience in server production and servicing. The company runs its own server room, as well as creates new ones for external investors.

Grants

We received two grants from the Polish Agency of Enterprise Development and we are in active cooperation with Koźmiński University.

- „Improving virtual currency deposit service through algorithms for proprietary blockchain network”

- "Development of an algorithm and software to optimise the routing of computing power between different blockchains"

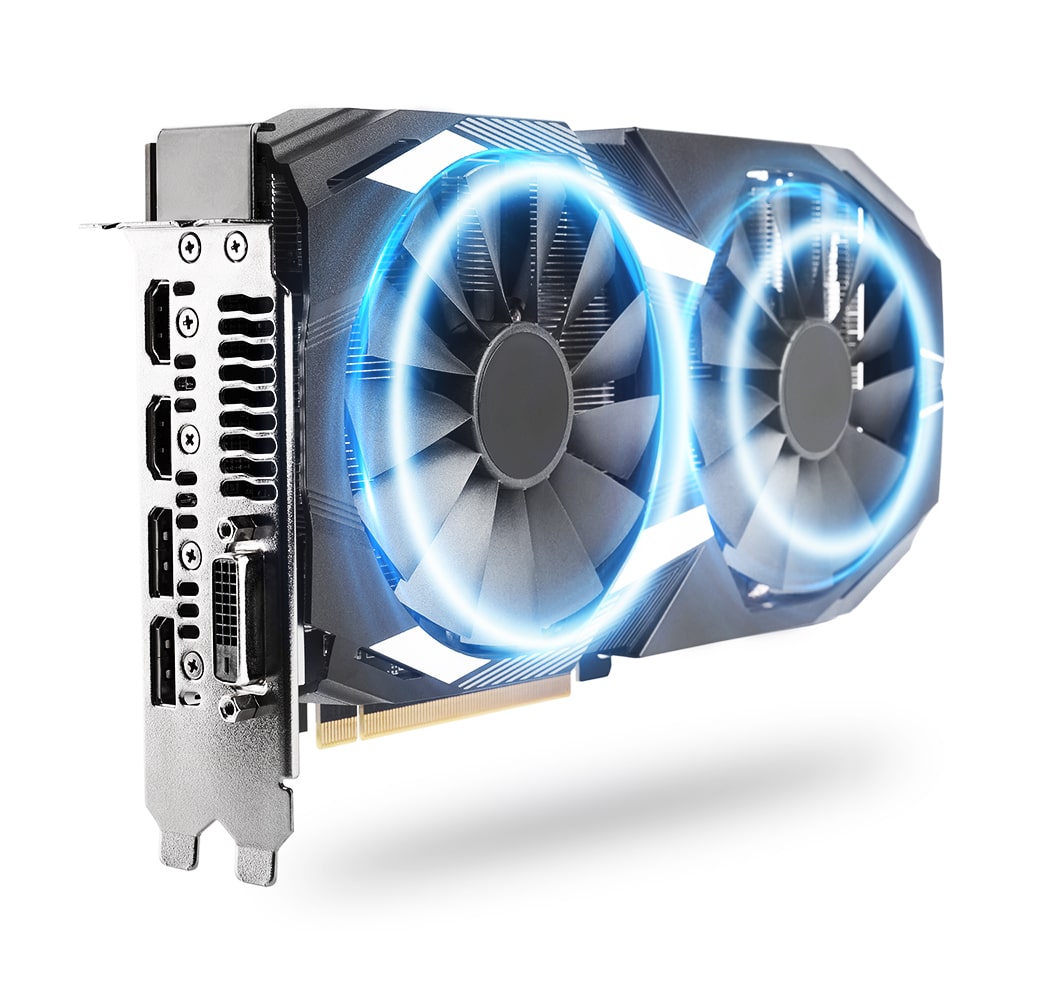

The Belters mining farm has been in operation since 2017. During this time it has been consistently developed, which allowed the mining farm to achieve a very high level of reliability and efficiency. The farm's current capacity is approximately 25 GH/s, which generates monthly profits of approximately $70,000*. Belters has proprietary power management software. The mining farm currently mines ETH, but we have the means to mine most cryptocurrencies available on the market.

Funds raised during the collection will enable further development of the Belters mine - increasing the power and scale of cryptocurrency mining, which will contribute to maximizing the generated profits. And this, of course, will be a huge benefit for investors.

*data as of 31st May 2020

Image caption

Image caption

Mining and the global cryptocurrency market

Image caption

Image caption

Mining is an integral process of generating, transferring and validating cryptocurrency transactions. It ensures stable and secure distribution of currency from payer to recipient.

Cryptocurrency mining is a process in which advanced machines with high computing power solve complex cryptographic problems. This involves finding a sequence of digits, known as a hash, that solves the relevant equation. Cryptocurrency mining machines require large amounts of electricity, and in order for mining to be effective, the machine’s efficiency must be of a sufficiently high standard.

While in theory, embarking on mining is not difficult - all it takes is acquiring the equipment and having the drive - in practice, the high cost of the venture can be a tough obstacle to overcome. When estimating profits from mining, you should also keep a few key factors in mind: the computing power of the equipment, the cryptocurrency exchange rate, the reward for mining a block, the price of electricity and the difficulty of mining. Individual cryptocurrency mining, due to hardware or financial constraints, can be tedious, costly and unpredictable in terms of generating tangible profits.

The revenue from digging cryptocurrencies depends on several factors, primarily on the price of the cryptocurrency, the difficulty of mining, the computing power of the entire network, and the price of electricity. The cost of electricity consumes 20-25% of the revenue from mined cryptocurrencies.

Image caption

Image caption

The cryptocurrency market is one of the fastest growing markets in the world. According to estimates provided by the Global Cryptocurrency Market Report, the value of this market is expected to grow by almost 40% within 5 years: from 1.6 billion USD in 2021 to 2.2 billion USD in 2026, with a CAGR (Compound Annual Growth Rate) of 7.1%.

The global cryptocurrency mining market is expected to grow by more than 81%: from USD 888.2 million in 2019 to USD 1614.7 million in 2025, with a CAGR as high as 16.1% between 2021 and 2025.

The COVID-19 pandemic had a huge impact on the global economy, including of course the cryptocurrency market. Over the past year, Bitcoin, Ethereum and other digital currencies have begun to significantly gain in popularity, even reaching all-time high values and trading volumes. It is undeniable that cryptocurrencies are becoming increasingly important on the international stage. The potential of digital currencies is beginning to be recognised not only by a niche of enthusiasts, but also by state authorities and politicians. The pioneer is El Salvador, whose congress in June 2021 became the first in the world to officially make Bitcoin as legal tender. It is only a matter of time before other countries follow in its footsteps.

Image caption

Image caption

Image caption

Image caption

Although mining holds great potential, with the growing popularity of cryptocurrencies, bull market, the pandemic and many other factors, the initial costs of mining cryptocurrencies have increased significantly. The changing landscape in this dynamic market and the increasing demands are a significant hindrance especially for those who are just looking to get started with cryptocurrencies and cryptocurrency mining.

Running one's own cryptocurrency mine is the goal of numerous people. However, the barrier constituted by insufficient financial resources, lack of appropriate knowledge and specialist equipment often makes this dream impossible to achieve. The Belters project offers a simple solution to this problem. BLT tokens allow holders to profit from cryptocurrency mining without the responsibility and pressure that comes with owning your own mine.

We are also keen to ensure that our activities are in line with the idea of sustainable development. We want to offer state-of-the-art solutions with minimal environmental impact. We realise that maintaining a mine consumes a significant amount of electricity, so we ultimately want to use energy from renewable sources.

Participating in the Belters fundraiser is a unique opportunity for cryptocurrency enthusiasts who themselves do not have the ability or means to run their own mine, but have ambition and believe in the potential of the crypto market. It is also an ideal option for those who care about making the world a better and more modern place in a conscious and thoughtful way.

- low entry threshold compared to the high cost of specialised equipment and electricity when setting up your own mine

- no specialist knowledge required

- professionals with many years of experience supervise the operation of the mining farm

- large-scale mining thanks to high power capacity

- environmentally conscious venture - eventually we will use renewable energy sources

- Belters infrastructure includes its own transformer connected to 15kV line, which provides us and our investors with lower costs of electricity

Image caption

Image caption

Investment objectives

Image caption

Image caption

The raised funds will be used primarily for the expansion of the mine and the replacement of graphics cards, fees such as electricity and rent, mine insurance. In addition, part of the funds will be used to buy TCRs from the exchange and burn them, distribution to all token holders of the project and commission for the Tecra Space platform.

Image caption

Image caption

We present financial data for those interested in the Belters project. Below you will find basic information about the BLT token and calculations about the crypto mine. In addition, in this tab you will find information about how the funds from the collection will be distributed, as well as what are the financial projections of the cryptocurrency mine in the long term.

BLT Token details

| BLT Token - Belters | |

|---|---|

| Number of tokens on sale | 500 000 BLT |

| Tokens that are not sold will be | Burned |

| Private round end date | 30th September |

| Premium account price (purchase via TCR) | 0.85 USDT |

Premium account price (purchase via USD, EUR, PLN or ETH, USDT) | 0.90 USDT |

Basic account price (purchase via TCR) | 0.95 USDT |

| Basic account price (purchase via USD, EUR, PLN or ETH, USDT) | 1.00 USDT |

| TCR token purchase limit* (basic account) | 1000 USD |

| TCR token purchase limit* (premium account) | 2000 USD |

Percentage of revenue | 80% |

The period of token repurchase | 48 Months |

Beginning of the repurchase | 2022 |

Frequency of repurchase | Monthly |

ROI soft cap | 53.54% |

ROI hard cap | 53.54% |

*In future collections conducted on Tecra Space, the investment limit via TCR will be higher. After reaching the limit, further investments are only possible in PLN, USD, EUR and ETH or USDT.

Allocation of collected funds

Image caption

Image caption

The raised funds will be used primarily for the expansion of the mine and the replacement of graphics cards, fees such as electricity and rent, mine insurance. In addition, part of the funds will be used to buy TCRs from the exchange and burn them, distribution to all token holders of the project and commission for the Tecra Space platform.

Image caption

Image caption

Image caption

| Calculation of Softcap (4.8 GH) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Year | Average ETH price | ETH annual production | Net revenue | Buying rate per year | Annual purchase value | Total amount of purchase | |||

| 2022 | $2 500.00 | 53.70 | $134 250.00 | 80% | $107 400.00 | $107 400.00 | |||

| 2023 | $2 925.00 | 40.28 | $117 804.38 | 80% | $94 243.50 | $201 643.50 | |||

| 2024 | $3 422.25 | 30.21 | $103 373.34 | 80% | $82 698.67 | $284 342.17 | |||

| 2025 | $4 004.03 | 22.65 | $90 710.11 | 80% | $72 568.08 | $356 910.26 | |||

| Calculation of Hardcap (9.6 GH) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Year | Average ETH price | ETH annual production | Net revenue | Buying rate per year | Annual purchase value | Total amount of purchase | |||

| 2022 | $2 500.00 | 107.40 | $268 500.00 | 80% | $214 800.00 | $214 800.00 | |||

| 2023 | $2 925.00 | 80.55 | $235 608.75 | 80% | $188 487.00 | $403 287.00 | |||

| 2024 | $3 422.25 | 60.41 | $206 746.68 | 80% | $165 397.34 | $568 684.34 | |||

| 2025 | $4 004.03 | 45.31 | $181 420.21 | 80% | $145 136.17 | $713 820.51 | |||

Image caption

Image caption

Package 1 - Wei

Includes:

- Joining the investors newsletter

- Electronic investor certificate

Requirements:

- Buy 100 - 499 BLT

Package 2 - Gwei

Includes:

- A one-year premium account on Tecra Space

- All bonuses from the Wei package

Requirements:

- Buy 499+ BLT

In response to your inquiries we have prepared a list of FAQs

Here are the major milestones in our company's development

Q1 2022

Q1 2022

Belters infrastructure development

Expansion and preparation of new crypto mine infrastructure.

Q1 2022

Q1 2022

Purchasing new graphics cards

Purchasing the most powerful graphics cards on the market to maximize crypto mine efficiency.

Q1 2022

Q1 2022

Graphics card installation

Adaptation of purchased graphics cards to the requirements and rules of the crpto mine, which were developed by a team of some of the most experienced cryptocurrency miners in Poland.

Q1 2022

Q1 2022

Increase mine capacity by 4.8 GH/s

With the funds raised (soft cap) we were able to complete the previous milestones which led to an increase in crypto mine capacity.

Q1/Q2 2022

Q1/Q2 2022

Purchasing new graphics cards

Purchasing the most powerful graphics cards on the market to maximize crypto mine efficiency.

Q1/Q2 2022

Q1/Q2 2022

Graphics card installation

Adaptation of purchased graphics cards to the requirements and rules of the crpto mine, which were developed by a team of some of the most experienced cryptocurrency miners in Poland.

Q1/Q2 2022

Q1/Q2 2022

Increase mine capacity by another 4.8 GH/s

With the hard cap funds raised, we were able to complete the previous milestones which led to an increase in mine capacity.

Fundraising terms of conditions

1 files

2022-02-06

Investment process

3 files

2021-09-06

Brief presentation

3 files

2021-09-06

50 032 624

50 032 624